NEW FORM 1099 FOR ROTH IRA

form 1099 for roth ira

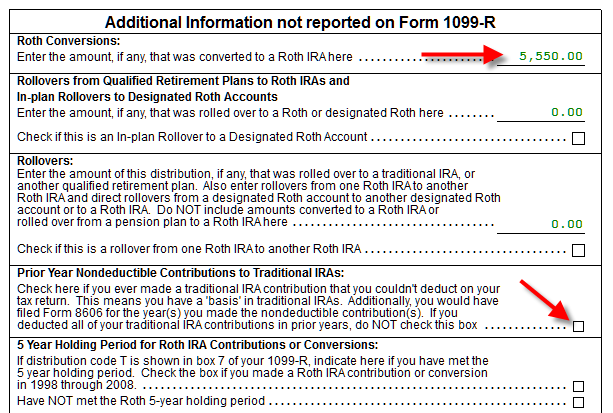

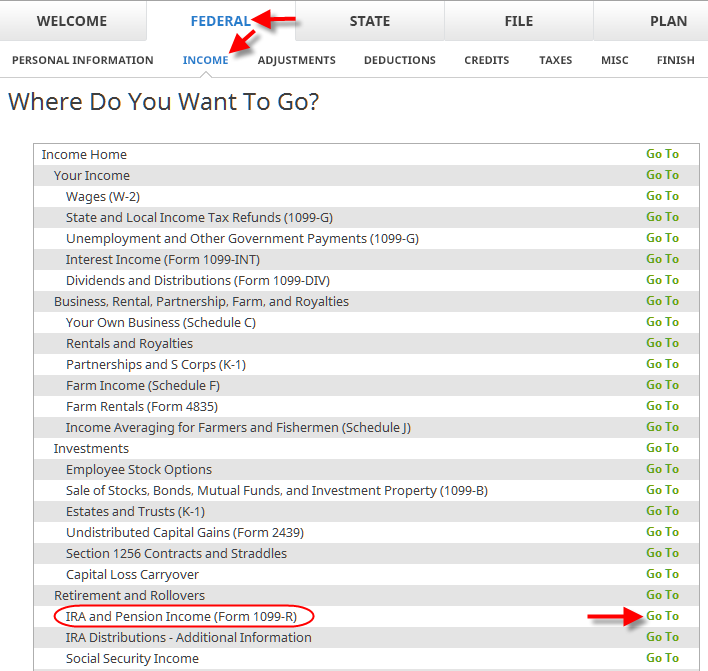

form 1099 for roth ira tags : /Designated Roth contributions or insurance premiums,†mean , Understanding Tax Forms , united states How to file form 8606 when doing a recharacterization , Scroll down. Fill in your conversion amount. Leave the Prior Year , 1099 R as you received it. Pay attention to box 2b, box 7, and the IRA , down and find IRA and Pension Income (Form 1099 R) . Click on Go To , united states Is this the right tax statement for Roth IRA back , Come tax time, you’ll receive federal form 1099 R that reports your , Simple Ira: Simple Ira Percentage , Simple Ira: Simple Ira State Farm , Image for item #03 401: Client Advisor Year End (FALL/Winter) Impr ,

Belum ada Komentar untuk "NEW FORM 1099 FOR ROTH IRA"

Posting Komentar